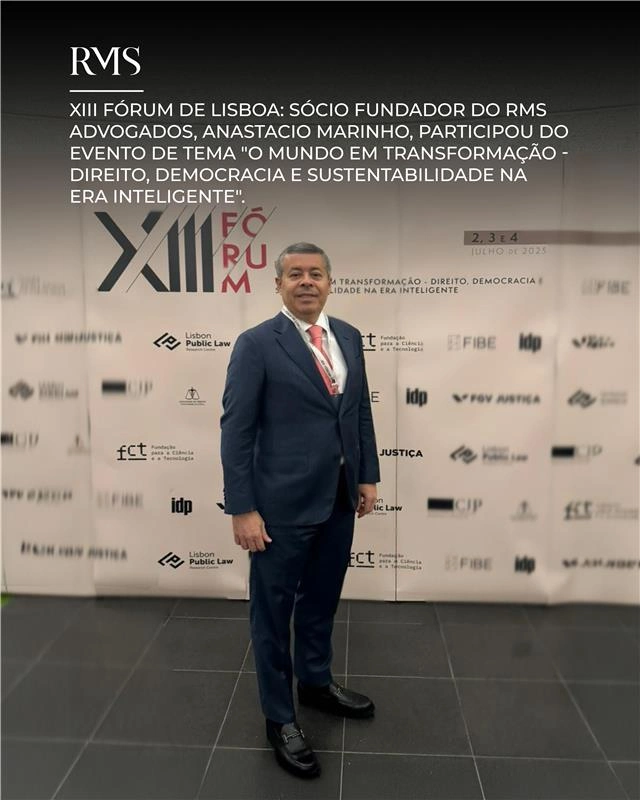

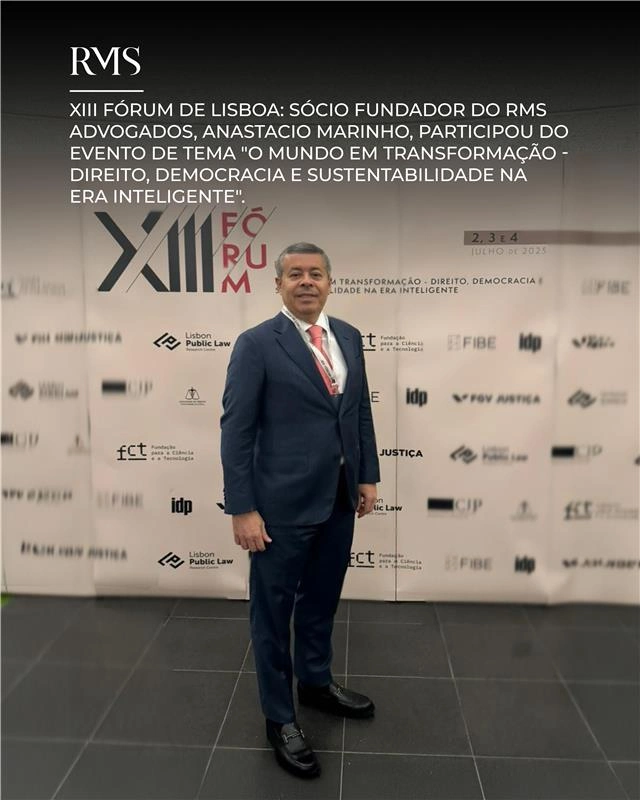

XIII Fórum de Lisboa: Sócio fundador do RMS Advogados, Anastacio Marinho, participou do evento de tema ”O mundo em transformação – Direito, Democracia e Sustentabilidade na Era Inteligente”.

Sorry, this entry is only available in PT.

The IBS would be a state tax, instituted through the National Congress, with a rate fixed by complementary law.

PEC 110/2019, signed by the President of the Federal Senate and 64 other senators, reported by Senator Roberto Rocha (PSDB-MA), aims at the extinction of nine taxes (IPI, IOF, PIS, Pasep, Cofins, CIDE-Combustíveis, Education salary, ICMS and ISS), which represent 31.7% of the federal revenue, with the creation of two other taxes, one on added value (Tax on Operations with Goods and Services – IBS) and the other selective on goods and services (oil, fuels, cigarettes, electricity, telecommunications services).

The IBS would be a state tax, instituted through the National Congress, with a rate fixed by complementary law, which may vary depending on the good or service, but being applied uniformly. In PEC No. 110/2019, the granting of supplementary tax benefits in specific operations is authorized by law, and the sharing of the collection takes place between the federal entities with the transfer of a share.

It is also proposed to extinguish the Social Contribution on Net Income (CSLL), which would be incorporated into the Corporate Income Tax (IRPJ). In this sense, it is provided that part of the referred tax (article 153, III, CF / 1988) will be used to finance social security, revoking the constitutional provision referring to CSLL (article 195, I, “c”, CF / 1988).

Currently, PEC is on the Federal Senate Constitution, Justice and Citizenship Commission, in which Senator Roberto Rocha presented a complement to the legislative report in early December 2019. At that time, the vote for the approval of PEC No. 110 / 2019, with partial compliance with some amendments, followed by the presentation of two new amendments also in December.

By: Wilson Sales Belchior

Sorry, this entry is only available in PT.

Sorry, this entry is only available in PT.